Hello and invite back to TechCrunch’’ s China Roundup, an absorb of current occasions forming the Chinese tech landscape and what they imply to individuals in the remainder of the world. It’s been an extremely hectic recently of October for China’s tech managers, however initially, let’s have a look at what a few of them are performing in the neck of your woods.

.TikTok’s problems in the U.S.

The difficulty dealing with TikTok, a growing Chinese video-sharing app, continues to deepen in the U.S. Lawmakers have actually just recently required an examination into the social media network, which is run by Beijing-based web upstart ByteDance , over issues that it might censor politically delicate material and be obliged to turn American users’ information over to the Chinese federal government.

TikTok is perhaps the very first Chinese customer app to have actually attained global scale — — more than 1 billion installs by February. It’s done so with a neighborhood of developers proficient at producing stylish, light-hearted videos, extremely localized operations and its acquisition of competing Musical.ly , which took American teenagers by storm. On the other hand, WeChat has actually had a hard time to develop a substantial abroad existence and Alibaba’s fintech affiliate Ant Financial has actually mainly ventured abroad through smart financial investments.

TikTok rejected the American legislators’ accusations in a declaration recently, declaring that it shops all U.S. user information in your area with backup redundancy in Singapore which none of its information goes through Chinese law. Quickly after, on November 1, Reuters reported pointing out sources that the U.S. federal government has actually started to probe into ByteDance’s acquisition of Musical.ly and remains in talks with the company about procedures it might require to prevent offering Musical.ly . ByteDance had no more remark to include beyond the released declaration when called by TechCrunch.

The brand-new media business need to have seen the heat coming as U.S.-China stress intensify in current times. In the long term, TikTok may have much better luck broadening in establishing nations along China’s Belt and Road Initiative, Beijing’s enthusiastic worldwide facilities and financial investment technique. The app currently has a footprint in some 150 nations with a concentration in Asia. India represented 44% of its overall installs since September, followed by the U.S. at 8% , according to information analytics firm Sensor Tower.

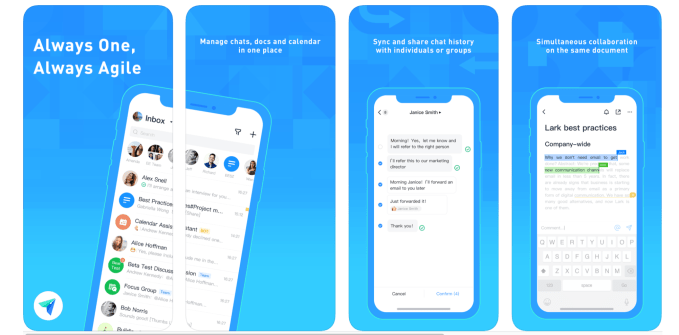

ByteDance is likewise hedging its bets by presenting a Slack-like office app and is supposedly marketing it to business in the U.S. and other foreign nations. The concern is, will ByteDance continue its heavy advertisement costs for TikTok in the U.S., which totaled up to as much as $3 million a day according to a Wall Street Journal report, or will it throttle back as it’s stated to go public anytime quickly? Or rather, will it acquiesce U.S. pressure, just like Chinese web company Kunlun offering LGBTQ dating app Grindr (Kunlun validated this in a May filing ), to unload Musical.ly?

.Huawei is still offering a great deal of phones.

The other Chinese business that’s been taking the heat all over the world seems faring much better. Huawei sticks on to the 2nd area in worldwide smart device deliveries throughout the 3rd quarter and taped the greatest yearly development out of the top-5 gamers at 29%, according to market analytics firm Canalys. Samsung, which came in initially, increased 11%. Apple, in 3rd location, fell 7%. In Spite Of a U.S. restriction on Huawei’s usage of Android , the phone maker’s Q3 deliveries consisted primarily of designs currently in advancement prior to the constraint was instated, stated Canalys. It stays to be seen how suppliers around the globe will react to Huawei’s post-ban mobile phones.

Another intriguing bit of Huawei handset news is that it’s partnered with a Beijing-based start-up called ACRCloud to include audio acknowledgment abilities to its native music app. It’s a suggestion that the business not just constructs gadgets however has actually likewise been boosting software application advancement. Huawei Music has a content licensing handle Tencent’s music arm and declares some 150 million month-to-month active users, both totally free and paid customers.

.Co-living IPOs.

China’s modern-day wanderers desire cost-saving and versatile real estate as much as their American equivalents do. The need has actually triggered apartment-rental services like Danke, which is in some cases compared to WeLive, a property offering from the now besieged WeWork that supplies fully-furnished, shared homes on a versatile schedule.

Four-year-old Danke has submitted with the U.S. Securities and Exchange Commission and noted its offering size at $100 million, usually a placeholder to compute registration costs. Backed by Jack Ma-controlled Ant Financial, the loss-making start-up is now renting in 13 Chinese cities, strongly growing the variety of houses it ran to 406,746 because 2015. Its smaller sized competing Qingke has likewise submitted to go public in the U.S. today. Running in the red, Qingke has actually broadened its readily available rental systems to 91,234 given that 2012.

Apartment leasing is a capital-intensive video game. Provider like Danke do not usually own residential or commercial property however rather lease from third-party house owners. That implies they are connected to paying leas to the property owners regardless of whether the homes are eventually subleased. They likewise bear big overhead expenses from remodelling and upkeep. Eventually, it boils down to which gamer can set up the most beneficial terms with proprietors and maintain occupants by using quality service and competitive lease.

.Worth your attention.WeChat has actually been rather limited in money making however appears to be just recently raising its industrial aspirations. The social networking giant, which currently offers in-feed advertisements, is broadening its stock by revealing users geotargeted advertisements as they scroll through buddies’ updates, Tencent revealed (in Chinese) in a business post today.Alibaba reported a 40% profits dive in its September quarter, beating experts’ quotes in spite of a cooling domestic economy. Its ecommerce section saw strong user development in less industrialized locations where it’s combating an intense war with competing Pinduoduo to record the next online chance. Users from these areas invested about 2,000 yuan ($ 284) in their very first year on Alibaba platforms, stated CEO Daniel Zhang in the profits call.Walmart’s digital combination is picking up speed in China as it revealed (in Chinese) that online-to-offline commerce now contributes 30% sales to its neighboorhood shops. Last November, the American retail leviathan started checking same-day shipment in China through a collaboration with WeChat.

Read more: feedproxy.google.com