Raise your virtual hand if you’ve ever bought a health insurance policy without really understanding what you’re buying, or because a banker or an agent talked you into it.

You’re not alone — most people buying a health insurance policy today do it because it’s what you’re supposed to do as an adult. And also because, over the last year or so, COVID-19 stressed the importance of having one.

Chances are that if you did take a closer look at the benefits your health insurance policy offered you, you’d find them to be somewhat insufficient or lacking, at least in one way or the other — either the room rent covered by the insurance, in the event of a hospitalisation, is far below that being charged in your city; or, if you’re pregnant or trying to get pregnant, the maternity benefits being offered are barebones.

Still, having a policy you don’t fully understand is better than not having one at all — which, sadly, is the case for a majority of Indians.

While financial limitation is a big part of the reason people don’t buy a health insurance policy, a lack of trust where consumers suspect bias and self-interest on the part of agents; an inability to understand what benefits their policy provides; and a vastly inaccessible online marketplace, which requires a laptop or a personal computer, to access are also big deterrents.

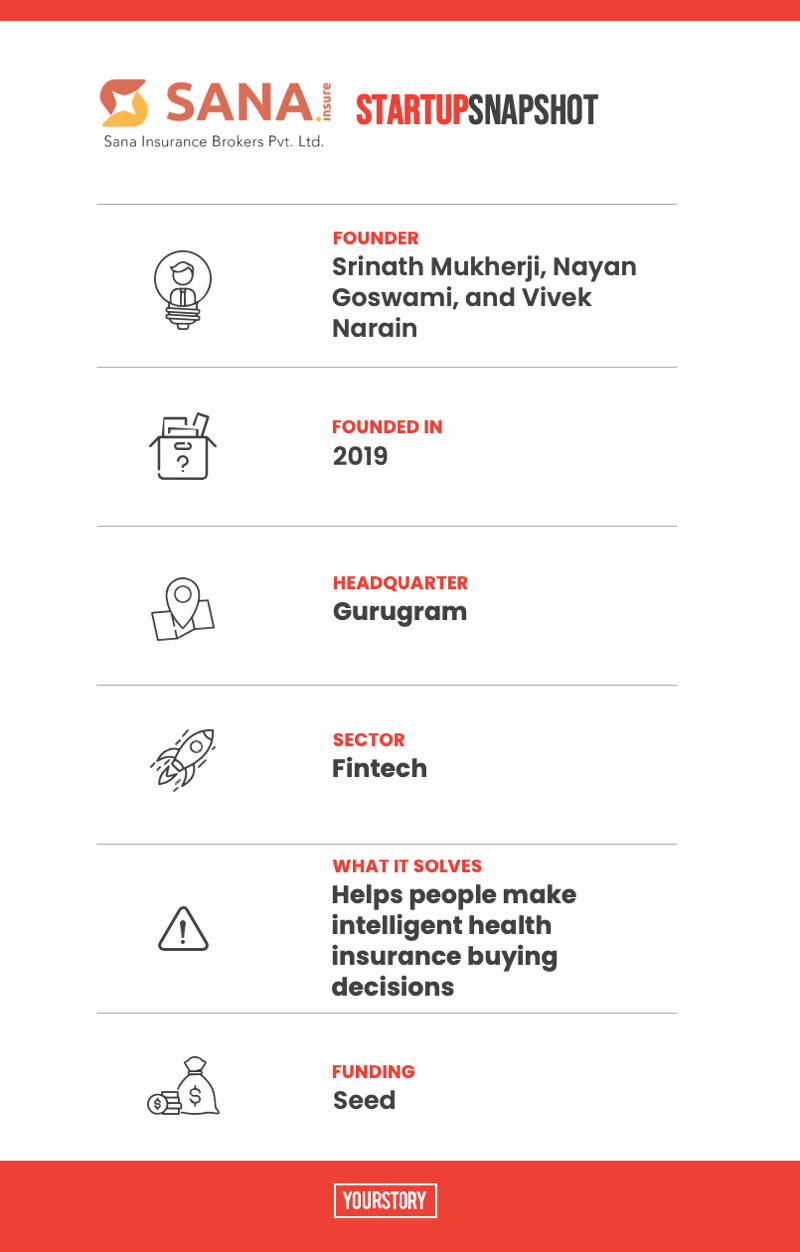

Solving that puzzle drove three entrepreneurs — Srinath Mukherji, Nayan Goswami, and Vivek Narain — to come together and set up SANA.Insure, an online health insurance aggregator.

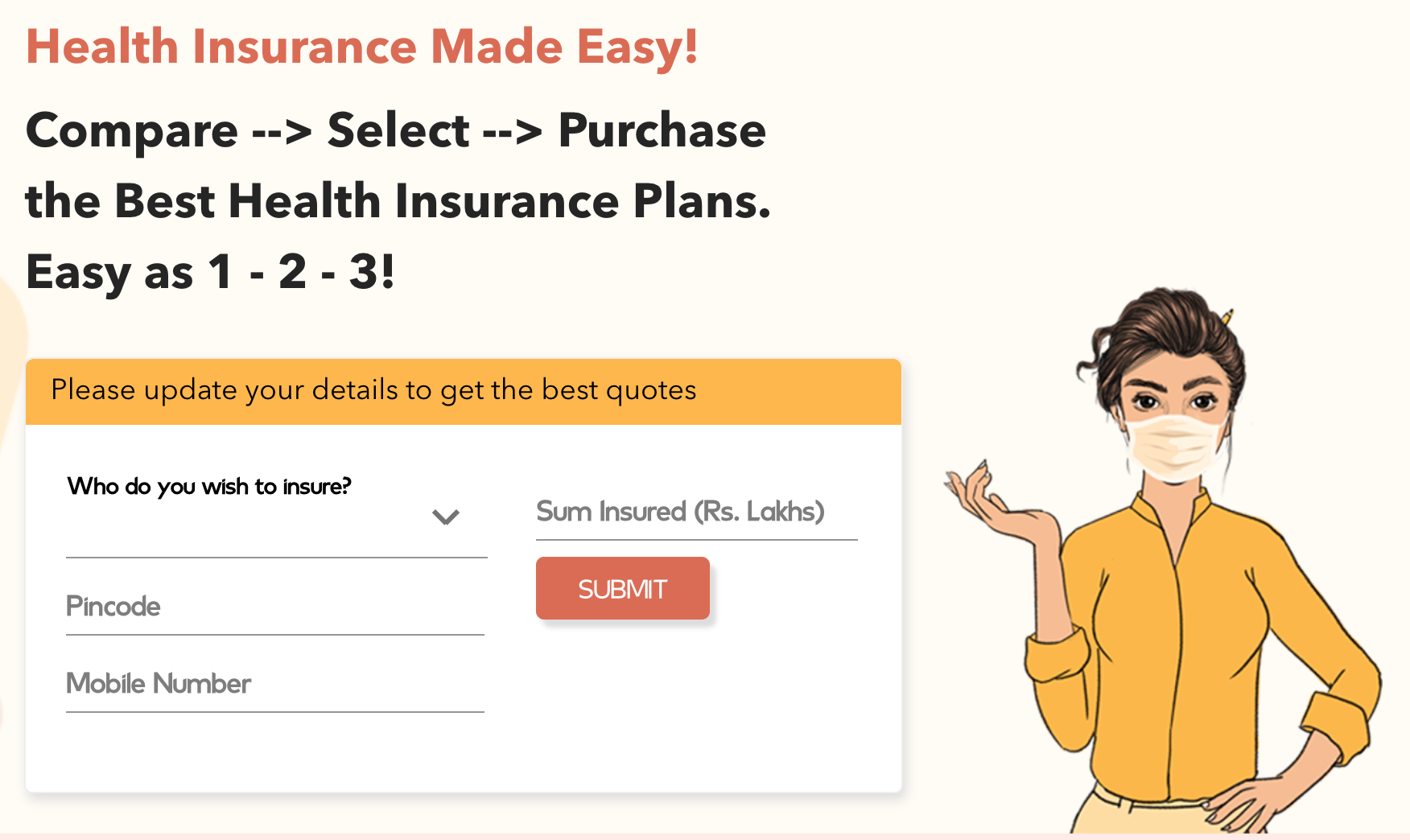

SANA.Insure’s modus operandi is quite unique and different from most online insurance marketplaces — it puts education about the health insurance policy a person is buying even before the actual purchase of it.

What that means is that if a user wants to buy a health insurance policy from SANA.Insure, they’re not given a rudimentary list of benefits that tell them almost nothing about how those benefits work, or if they’re even adequate. It breaks all the information down into easy-to-understand terms, and colour-codes it to indicate how useful they are to the person buying it basis their age, location, gender, and more.

“With SANA.Insure, our aim is to build a transparent, simple, and highly accessible platform for families to purchase and manage their health insurance, using very sophisticated digital technologies behind the scene,” Srinath, Co-founder and Director of Sana Insurance Brokers tells YourStory in an interview.

The Gurgaon-based startup features over 150 plans on its website, provided by 16 general and health insurance companies. Over 15,000 people have bought a health insurance policy from SANA.Insure, via group and individual policies. Its founders have invested over $500,000, personally, and are currently exploring institutional funding.

ALSO READ

How FamPay went from having to shut down operations during the pandemic, to growing its user base 10X in months

The differentiator

SANA.Insure solves the trust issue by allowing buyers to select health insurance policies on the basis of their personal profile and requirements. By eliminating agents who push policies based on the payout they receive from the insurance firm, the startup is able to provide advice that is not biased, and actually benefits the consumer more than the company.

It solves the issue of complexity or not understanding an insurance policy by breaking down all its benefits into easy-to-understand parameters that can be understood by the layperson, and generating a detailed analysis of the insurance policy.

SANA.Insure created this database by manually gathering information on health insurance plans available, identifying common features and benefits offered, and then colour-coding all of this information to make it easy for the user to understand the policy. It used all this information to create a proprietary product called SANABase, a master list of over 150-plus health insurance plans that contains nearly 180 parameterised items.

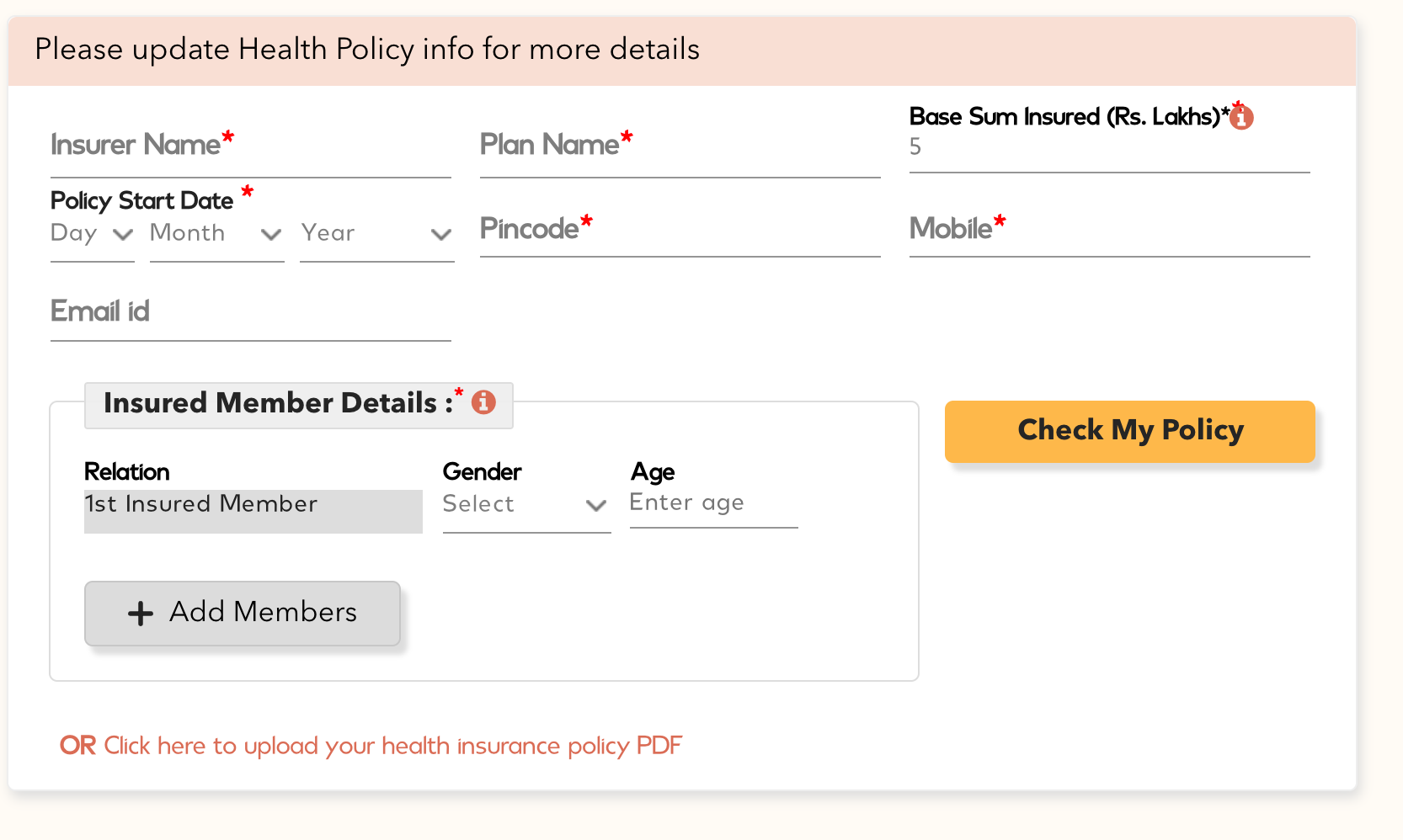

The SANABase powers its SANACheck service, a free tool that anyone — even users who haven’t bought their policies from SANA.Insure — can use to find out more about their health insurance plan.

“Our next big step will be to offer recommendations based on key inputs on specific personal needs,” says Nayan, Co-founder of SANA.Insure and head of its general insurance business.

Cognisant of the fact that a majority of Indians, especially in lower-tier cities, access the internet via their mobile phones, the startup designed the portal to fit a mobile screen, and also enabled part of the buying journey on WhatsApp. Soon, it hopes the help facilitate almost the entire insurance buying process on WhatsApp, the startup says.

SANACheck

ALSO READ

Using new-age tech, this startup is making insurance selling in India more efficient

Solution for corporates and SMEs

Apart from selling directly to customers, which is its biggest business, SANA.Insure also helps corporates and SMEs buy group health insurance policies for their employees.

It takes health insurance policy buying a step further and provides a suite of wellness services, in partnership with many health and wellness service providers — offering “health with health insurance”.

“Our mission is to provide personalised care in health insurance through digital technologies, and our vision is to become the leading source for health insurance,” says Vivek, Co-founder and promoter of Sana Health Solutions.

He envisions Sana Health Solutions playing a larger role in the future, and becoming a sort of an aggregator for health and wellness services. Imagine coming to a portal to not only buy a health insurance policy, but also a host of discounted wellness services such as counselling, meditation, yoga sessions, and the like.

The startup’s target market includes households in Tier II and III cities that have one or more salaried or self-employed earners in the 30-40 years age bracket. To increase its useability, SANA.Insure plans to launch the portal in vernacular languages, and provide human assistance services in those languages as well.

It draws its revenue in the form of brokerage paid by insurers. To date, it reported annualised revenue of around Rs 1.5 crore.

“We are still very much in investment mode, given that we are building a retail brand and that too in health insurance, which is typically an annuity business,” Srinath says.

“Our biggest challenge has been to build a trustworthy retail brand, based on integrity, care, and expertise, in a regulated industry that does not allow discounting or other financial incentives for customer acquisition,” he adds.

ALSO READ

How the hospitalisation of ex-AT&T exec’s father led him to revolutionising corporate healthcare in India

The startup is currently exploring a deal with a Malaysian team of insurance and tech experts to lift-and-shift its model to Malaysia and introduce similar services there. It also said it foresees similar opportunities in Indonesia and the Philippines, where health insurance penetration is low.

SANA.Insure’s competitors include Policybazaar.com, Instabima, Coverfox, and PolicyX, among several others aggregators that allow people to compare policies before purchasing — but none, perhaps, offer the level of detail SANA.Insure does.

A recent survey by the National Sample Survey found that 85.9 percent of rural Indians, and over 80 percent of urban Indians did not have any sort of health insurance cover.

The health insurance sector’s market size in India is expected to cross over Rs 2 trillion by 2030, up from about Rs 370 billion in FY18, according to Statista, signalling a lucrative opportunity for health insurance companies and brokers.

Edited by Teja Lele Desai

Read more: yourstory.com