Raising funds is a huge obstacle start-up creators need to come to grips with in the course of structure and growing their companies, particularly when it pertains to conversations around equity cuts. Circumstances of creators losing control over their own business as they grow — — and the business seemingly wandering off far from its objective as stakeholders put in control — — are a penny a lots.

Not wishing to part with a great deal of control in their own business results in creators losing out on important funds and time they might have utilized to scale.

Enter revenue-based funding — — a principle that is gradually taking the start-up world by storm. Revenue-based funding is where the financing business takes a little cut of an endeavor’’ s future profits stream as a flat charge, in exchange for development funds. There ’ s no equity dilution included, nor exists any financial obligation of any kind — — win-win for the start-up trying to find fast funds without the long, tough pitching procedure.

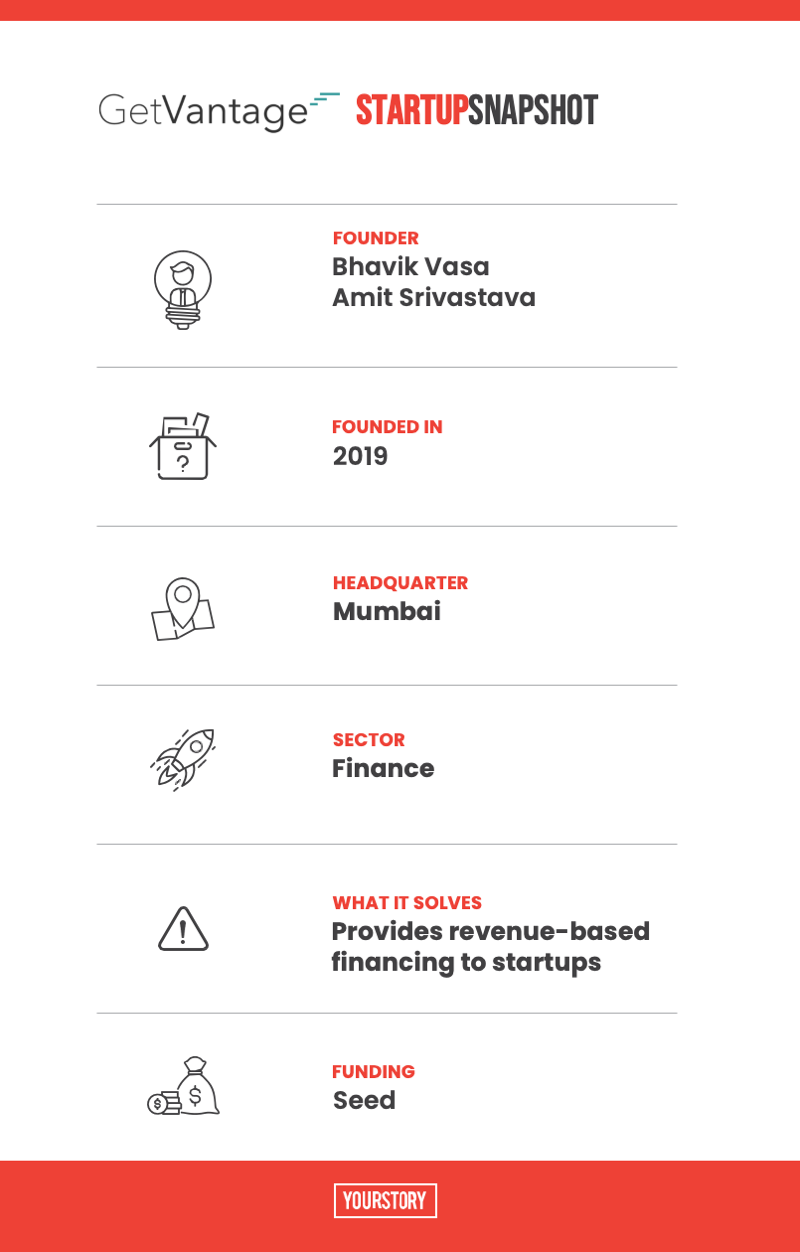

Mumbai-based GetVantage , established by Bhavik Vasa and Amit Srivastava, ex-founders themselves, is one such business.

GetVantage offers revenue-based funding to growth-stage start-ups. It utilizes an exclusive machine-learning-based credit choice engine, and an offer management system to determine a start-up and assess’’ s future profits efficiency, and provides a term sheet based upon its findings.

““ Today, the VC design is rather damaged and truly based upon who you understand. Creators end up being based on the quality of their networks to make the best intros to financiers and can invest months courting them, just to be turned away,” ” Bhavik informs YourStory.

““ What ’ s even worse is that those who do handle to raise equity financing are offering control and watering down ownership, which just increases as business is more effective. That’’ s not right, ” he includes.

GetVantage is Bhavik ’ s solution to pricey equity asks and individual connections that might lead to prejudiced financing activities. By taking individual connections out of the formula, he intends to democratise fundraising, in addition to guarantee that the most strong companies and deserving creators get the funds they require to get to the next level.

GetVantage’’ s viewpoint

Having co-founded a fintech start-up, Radical Payments, himself, Bhavik states he understands the troughs and crests of the entrepreneurial life, and he desires GetVantage to be identified for more than simply its cheque-cutting capabilities.

He states he wishes to construct an environment that comprehends the goals and dreams, along with the problems of a creator. GetVantage, for that reason, is placed as a business constructed by creators, for creators.

““ GetVantage was produced to be a real creator’’ s platform, constructed by creators (and operators) for creators. We aren’’ t ex-investment lenders, or experts — — we are seasoned business owners creating a much better method for the environment to grow. With GetVantage we’’ ve presented a smooth financing option that is transparent and founder-friendly. We aren’’ t interfering with, however we’’ re improving the landscape of endeavor financing in the favour of creators,” ” he states.

GetVantage creator’s platform

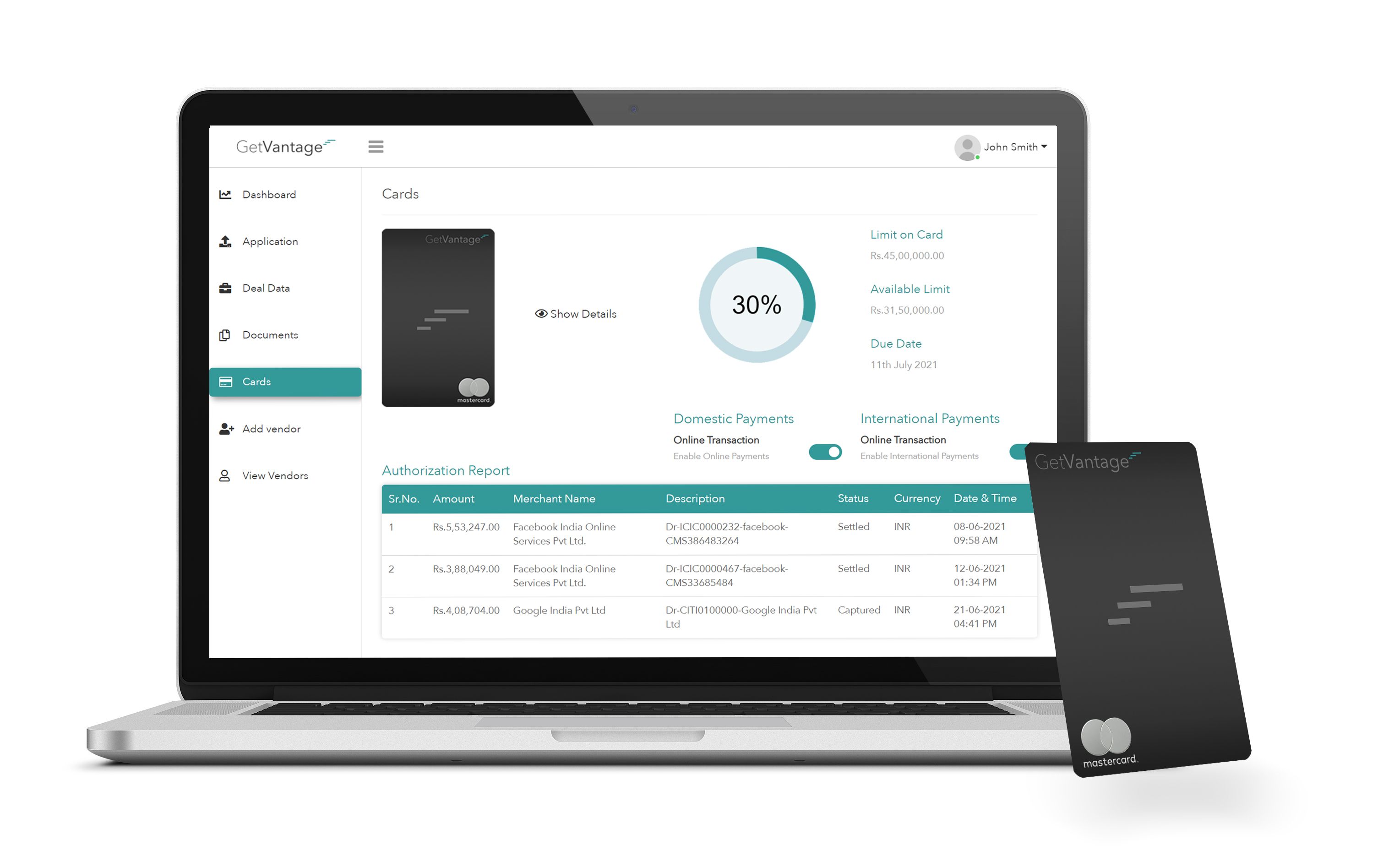

The start-up makes great on its founder-first approach in the method it processes and welcomes financing applications– rather of networking, pitching, returning with responses and after that working out, GetVantage asks start-up creators to just plug their digital marketing and profits accounts into its platform, following which its exclusive credit engine carries out a comprehensive analysis to determine the business ’ s future income stream.

If a start-up ’ s metrics ticks all of GetVantage ’ s boxes, it creates a term sheet– which can take place in a matter of couple of days, rather than months, frequently seen when raising institutional financing.

“ The monetary tension that features fundraising can be a considerable diversion for young business owners and newbie creators. Revenue-based funding removes a great deal of the tension and friction from the conventional fundraising procedure, enabling entrepreneur to concentrate on development and let companies like GetVantage supply the capital, ” Bhavik states.

Beyond capital, GetVantage assists its portfolio business gain access to over 25 functional services that can assist them simplify their operations. Its FoundersForFounders.org effort links creators with each other so they can form a strong network, along with connect for troubleshooting, guidance, and more when required.

Revenue design

As with a lot of revenue-based funding services, GetVantage takes a cut of the profits created by business it offers moneying to. Its charge cut begins at 6 percent of the overall earnings made.

Funding ticket sizes differ in between$ 25,000 and$ 250,000, and do not need any equity dilution, board seat grants, warrants, concealed charges, individual assurances, or prior connections.

The one, overarching requirements the start-up does hold of utmost value is business must be digital-first– otherwise, the start-up is sector-agnostic.

ALSO READ —

ALSO READ —  Financial Inclusion: How fintech start-up Nayaseva is assisting rural Indiapay its costs

Financial Inclusion: How fintech start-up Nayaseva is assisting rural Indiapay its costs

So far, GetVantage has actually invested throughout the ecommerce, SaaS, video gaming, D2C, food and drinks, individual&care, vehicle, health and health, garments, nutrition, and more. Its portfolio has almost 100 brand names, consisting of Arata , Rage Coffee , Power Gummies , Flo, Super Bottoms, Dr Sheths, to name a few.

The start-up finished its seed round from Chiratae Ventures, Dream Incubator Japan, Samyakth Capital, and a host of other popular angel financiers. It has actually raised almost$ 5 million in financing up until now, and is presently in active conversations with worldwide financiers.

“ For too long now, the market has actually gone after a pipeline dream- grow quickly, grow at any expense, and hockey-stick curves. It ’ s time for that to end and we require to drive that modification by example, ” Bhavik states.

GetVantage ’ s rivals consist of Klub , Velocity Finance, and N +1 Capital , to name a few.

The Indian start-up scene is at a crucial inflection point presently, with financiers from throughout the world gathering. In the very first half of 2021, Indian start-ups raised almost $10.15 billion, throughout 543 offers, and from 1,020 active financiers. With a substantial federal government push, along with the motivating IPOs of some landmark Indian start-ups, the environment is poised to continue growing, offering profitable chances for business like GetVantage.

Edited by Teja Lele Desai

.

Read more: yourstory.com