Over the in 2015 of year of the pandemic, we’’ re yapped in this area about a few of the unintentional repercussions of the pandemic. Media interruption has actually taken lots of types, developing losers and winners. In our COVID research studies, carried out in 3 waves amongst fans of business, public, and Christian music stations, we had the ability to track these patterns.

By and big, Netflix, cable television and broadcast TELEVISION, and social networks all got an increase throughout the throes of 2020. On the other hand, satellite radio and broadcast radio –– not a lot.

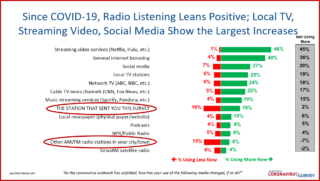

But when you took a more detailed take a look at the information, it ended up being clearer the projections for radio weren’’ t so clear. The chart below is amongst business radio listeners from the very first wave (late March/early April 2020). In general, 16% stated they had actually been investing less time listening to their preferred station considering that the start of COVID. 18% reported really investing more time listening to their favored stations. Lots of take and offer.

But when you worked down the list, you might see more disintegration for secondary stations –– P2 and P3 options –– with a much bigger portion tuning far from these other in-market choices. How do we describe this?

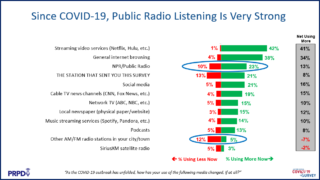

A take a look at our public radio buddy study, carried out at the specific very same time, was more revelatory. Public radio regional stations in addition to NPR (we consisted of both simply to be sure) fared even much better –– 23% more/10% less. And like we saw in the industrial radio variation of this research study, regional P2 stations were most likely to be deserted by these public radio fans –– 8% more/ 15% less.

At the time, we presumed this concept:

While work from house caused less time in the vehicle, and the scourge of joblessness were the offenders in rotting radio listening time, numerous other participants really were investing more time with their P1 stations. We thought that reliable and familiar radio options –– music and talk stations and their characters –– offered a sense of convenience and dependability ““ throughout these unpredictable times.””

.  Photo: Clay Blackmore 2007.

Photo: Clay Blackmore 2007.

Now, an analysis by David Giovannoni in public media ’ s Current confirms what we ’ ve been seeing for more than a year.

.

If you ’ ve invested more than a cup of coffee working in pubic’radio, you understand Gio. He ’ s a 35,000 foot observer of the medium, a scientist who has regularly and remarkably utilized analytics and reasoning to set out the reasoning for why things are the method they remain in public radio.

.

Above the fray of the ridiculous news cycles, modifications in rankings methods, and the other variables that tend to puzzle developers and supervisors in the trenches, Giovannoni has actually clung to his megatrend theories about public radio ’ s real health, its difficulties, and its chances.

.

His A udiGraphics service puts Nielsen information( previously Arbitron) in a much various point of view than industrial radio stations generally see.

.

In an appropriately post entitled post, “ For their listeners, NPR News stations are the last thing worth listening to on the radio, ” Giovannoni sets out an engaging case.

.

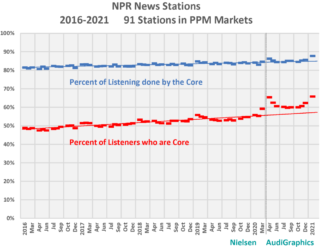

“He makes 5 bottom lines:

. As pandemic listening rapidly moved from out-of-home (in-car and at-work) to at home precisely one year back, NPR News fans discovered a method totune in their preferred stations.We ’ ve spoke about the advantages of simple, smooth, and well marketed digital circulation. NPR and the majority of its member stations have actually been well ahead of this curve with apps, streaming, on-demand material, podcasts, and creative wise speaker techniques. As cars and trucks beinged in driveways, public radio P1s were tuning in their preferred stations on other gadgets– in droves. Listeners concentrated on their NPR News P1 stations, frequently at the expenditure of their in-market rivals. You can see that in our slide above, along with in David ’ s – information listed below.This merging towards one ’ s preferred, a lot of relied on station advantages brand names that have regularly done fantastic work. COVID amped up core commitment to preferred stations’– particularly NPR News outlets. Public radio has actually’constantly been near and dear to its fans. Frequently after performing focus groups for stations or the network, I ’ ve strolled down to the parking area just to find a group of enthusiastic, energetic participants still discussing the station, the programs, and the characters they like and worth. COVID functioned as a call to action for fans who were currently dyed-in-the-wool followers. Listener commitment didn ’ t simply occur– it ’ s been “ years in the making. ” That ’ s Giovannoni ’ s quote, and he ’ s area on. And it took the pandemic to activate this habits. A great deal of time, cash, and effort has actually – been “invested looking into the audience, and reacting with programs, material, and services that fulfill their requirements. Everything settled throughout COVID. A higher portion of an NPR News station ’ s audience is now comprised of core listeners. It is now pressing the 2/3s mark.( It utilized to be closer to 1/3. )Listeners are genuinely coalescing around their preferred stations– and investing less time with everybody else. What ramifications does this have post-pandemic? While it ’ s excellent to see P1s broadening their time( and contributing economically), exists a drawback for secondary and fringe listeners maybe not being as engaged as they when were? Gio ’ s slide listed below programs the growing value of core listeners to public radio ’ s new-found success:.

’

Perhaps it took a life-altering occasion like a pandemic to put everything this into focus, and the after-effects of the “ Trump Bump ” as it was described in public radio circles doubts. Gio ’ s analysis recommends NPR News has actually never ever been more crucial to its audience throughout the COVID Era, and never ever served its audience much better.

.

This is no mishap. Both at the network and station levels, public “radio has actually invested years comprehending its audience, crafting material to satisfy their requirements, and establishing circulation channels that stay up to date with– and even remain ahead of– the patterns.

.

The outcome? An even higher determination to support these stations economically– oneof the crucial metrics that identifies public radio ’ s health and success.

.

So, how do we determine this phenomenon of commitment– particularly when it changes into word-of-mouth suggestions, the Holy Grail of marketing?

–.

Is public radio – commitment an abnormality with these stations– particularly the news outlets– or does business radio have a comparable story to inform –?

.

That ’ s why we ’ ve been asking the Net Promoter concern considering that 2004 in our Techsurveys. Now, we have almost twenty years of tracking information, developing a clearer image of how public radio has actually fared for many years.

.

.

And thanks to our brand-new Techsurvey 2021 coming out of the Excel oven, we ’ ve got relative information for business radio– in addition to the 14 various formats we track– whatever from Rock to News/Talk to Urban Air Conditioning to Country.

.

Loyalty and word-of-mouth are essential efficiency signs for radio– the understandings that drive listening, assistance, and engagement. And like in David Giovannoni ’ s research study for public stations, industrial radio listening has actually likewise progressed into more of a fan-based activity’.

.

In this year ’ s Techsurvey 2021– the very first one carried out throughout COVID– there have actually been some – remarkable shifts, sustained by the effect of the pandemic. When we drill down to formats, there ’ s plenty of excellent news for here for industrial radio and some surprises.

.

We ’ ll break everything’down in tomorrow ’ s post.

.

Loyalty is back. How do we hold onto it?

Thanks to Abby’Goldstein for the heads-up.

.

Read more: jacobsmedia.com