For the last couple of months, companies worldwide have actually needed to quickly adjust to the effect of COVID-19.

In a time where it looks like things alter every day, it can be tough to determine whether the obstacles your organisation is dealing with are extensive.

That’s why we’re releasing week-over-week benchmark information for core service metrics like site traffic, e-mail send out and open rates, sales engagements, close rates, and more. These core metrics are divided by area, business size, and market cuts, so you can check out information for business most comparable to yours. You can discover the information, and more context on the dataset and sources, here .

Because the information is aggregated from our consumer base, please remember that specific organisations, consisting of HubSpot’s, might vary based upon their own markets, consumer base, market, location, phase, and/or other elements.

These insights are revitalized every Thursday early morning ET, and will be accompanied by this brief writeup. You can discover previous writeups utilizing this timeline .

We want to develop helpful standards to determine your company versus, and act as an early indication of when brief- or long-lasting modifications might be required in your technique.

.What We’re Seeing.

Here are the 3 crucial takeaways from the most current week’s information:

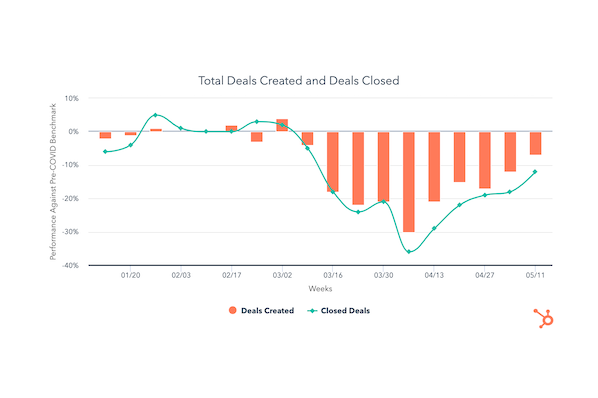

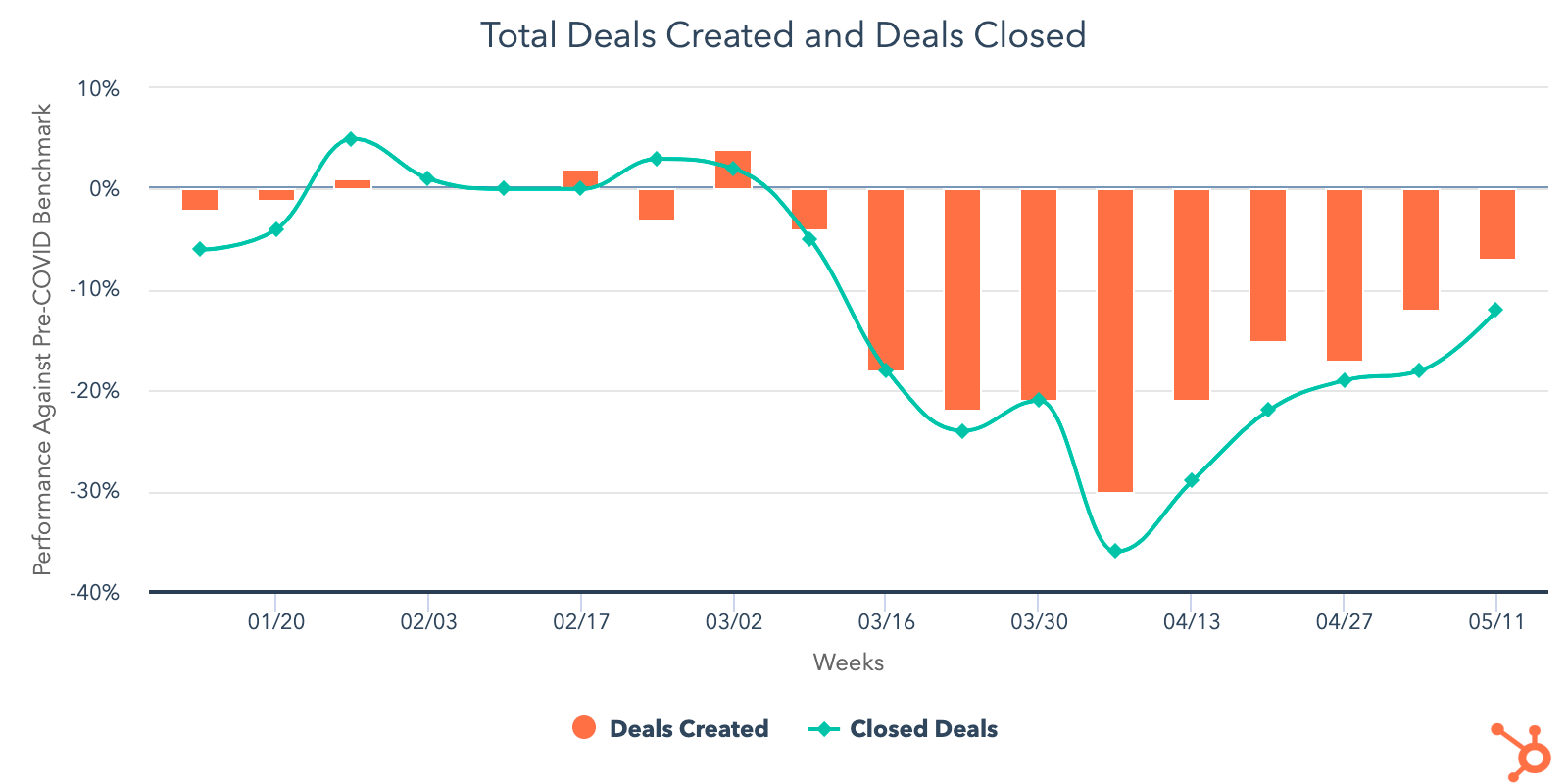

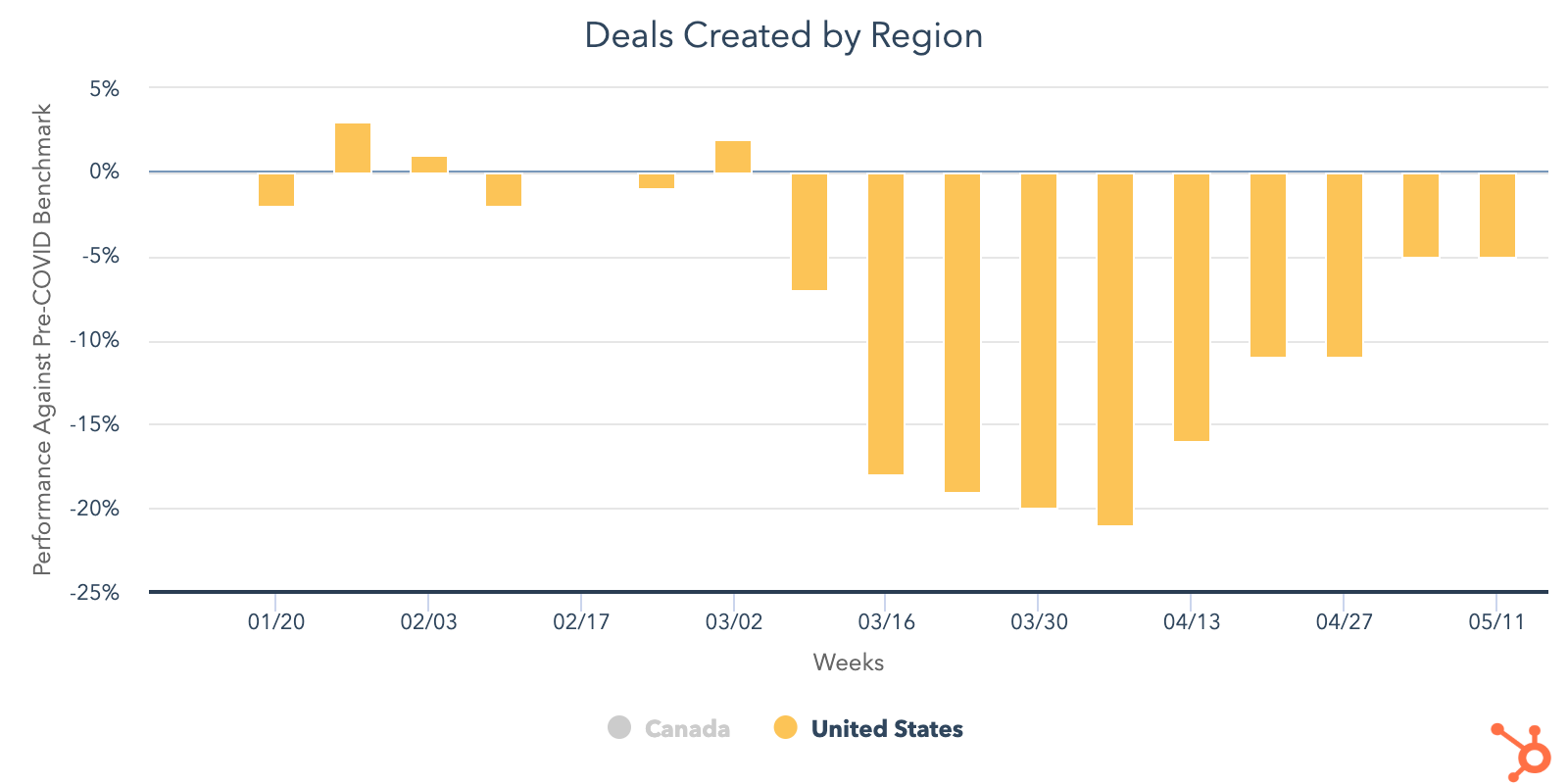

.1. Offers produced and closed gain favorable momentum as some nations and markets reveal motivating efficiency towards mid-May.

After a 6% boost throughout the week of May 4, worldwide offers developed increased another 6% recently. Offer production is still 7% listed below pre-COVID levels, however this metric has actually been trending in a favorable instructions over the previous couple of weeks. The variety of offers closed likewise increased by 8%, which is an appealing indication after seeing the current increase in offers produced previously this month. The combined development of offers produced and offers closed ought to offer optimism for sales groups, particularly those operating in markets that have not been as structurally affected by COVID-19.

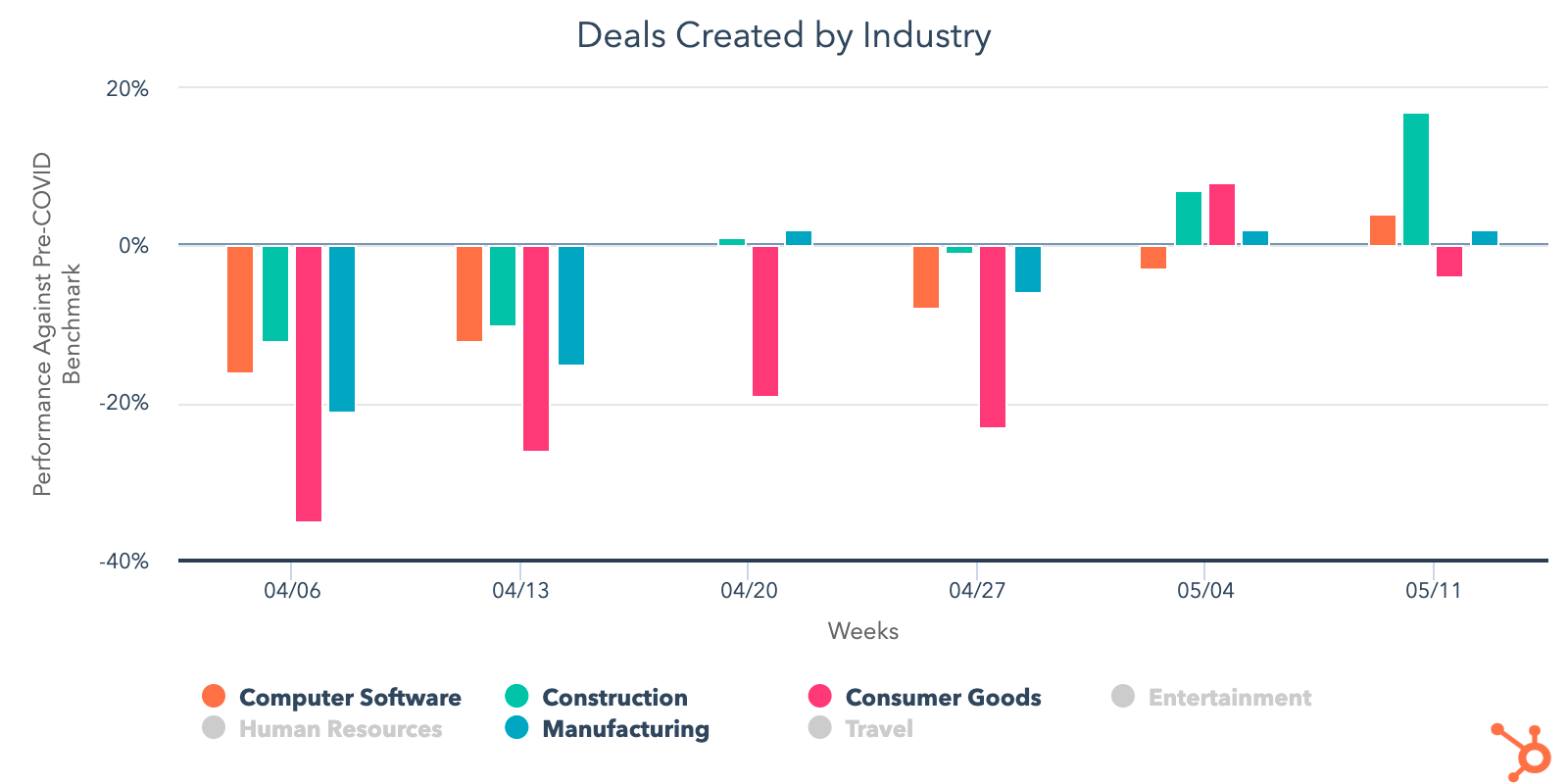

Almost all markets experienced a boost in offer production throughout the week of May 11, other than for durable goods which dropped 11% from the previous week. There are now 4 markets that are trending near to or above pre-COVID levels as building and construction is 17% above, computer system software application is 4% above, and production is 2% above the standard. Durable goods is trending 4% listed below pre-COVID levels, and although it experienced a drop in offers developed recently, that dip was accompanied by a 17% boost in offers closed-won , which is a confident indication for sales groups as we move towards completion of May.

For the last numerous weeks, we’ve been taking notice of nations that have actually remained in the news for resuming their economies. Italy, Spain, and Germany, all saw boosts in offers developed throughout the week of May 11. Italy experienced the biggest bump with a 12% boost in offer development and a 14% boost in offers closed. Germany had a 5% boost in offers produced and remained on par with international averages for offers closed. Germany’s efficiency resembles Australia’s as offers developed there were 6% greater throughout the week of May 11 and are now trending simply above pre-COVID levels.

The United States is another nation that’s near the top of our watchlist. You can explore its macro-regional information here, however we’ll supply a more comprehensive breakdown later on in this post.

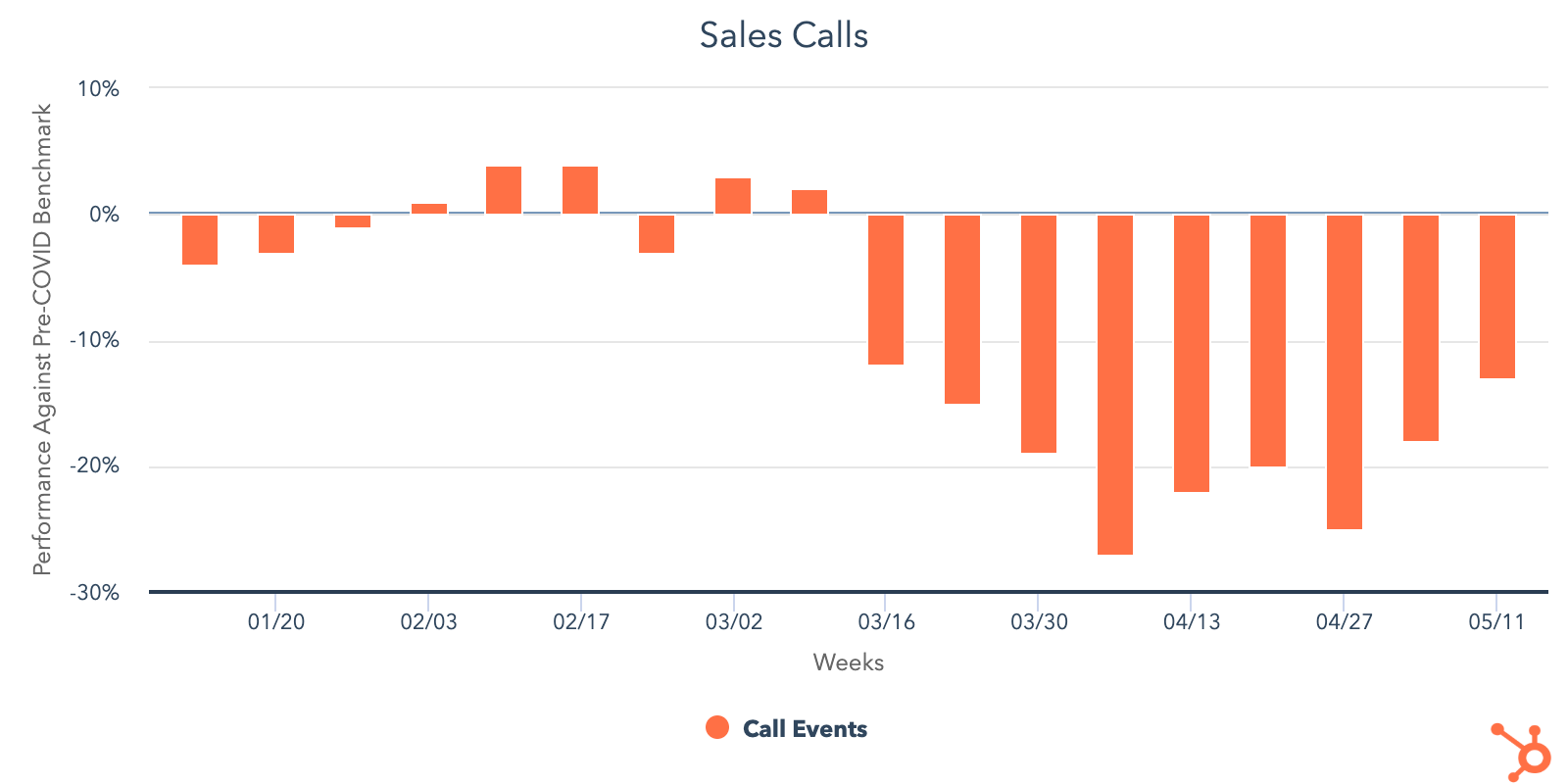

.2. Sales groups go back to calling, marketing metrics reveal strong engagement, and the need on incoming channels stays high.

After weeks of staying flat, sales e-mail reaction rates saw a minor boost throughout the week of May 11. While reaction rates are still listed below pre-COVID levels, this current increase in engagement has actually paved the way for more sales activity.

Previously, e-mail action rates reached their most affordable average this year, however as they reveal indications of healing in May, sales groups have the ability to resume greater levels of other, more direct prospecting activities, like call. Call volume has actually increased 16% because the week of April 27 and contact development has actually stayed constant with pre-COVID averages throughout the week of May 11. Now that more states and nations are beginning to open back up, we’re seeing services going back to conventional outreach channels like calling customers and reserving conferences.

Marketing metrics, on the hand, stay strong. Online marketers sent out less e-mails today, however send out and open rates continue to trend well above pre-COVID levels. Email engagement was especially high throughout the week of May 11 as open rates are presently trending 29% above the criteria. That’s approximately a 10% increase from the previous week.

Engagement for other marketing channels stays strong. Customer-initiated discussions increased 4% throughout the week of May 11 and are 33% above pre-COVID levels. Web traffic was up recently, too, sitting at 23% above the standard. This shows that there’s still a fantastic need for incoming methods as individuals begin to gravitate towards various marketing channels.

.3. The United States stays on par with worldwide sales activity as the nation starts to resume its economy.

As states throughout the U.S. continue to lighten and resume services COVID-19 limitations, sales activity has actually started to rebound. Deal production has actually stayed progressively enhanced over the previous 5 weeks and presently the U.S. is just trending 5% listed below pre-COVID levels. Offers closed-won increased by 2% also, leading to the most closed-won offers for the nation given that the week of April 6, when almost all of the nations we’re tracking experienced a considerable dip. The U.S. is still 10% listed below the pre-COVID criteria for offers closed, we hope this will enhance as we near towards the end of May.

The volume of sales e-mails for the U.S. continues to pattern above pre-COVID levels landing at 70% for the week of May 11. Action rates stay listed below pre-COVID averages and, like sales volume, stayed flat compared to the previous week. In addition, after trending downward in mid-March, call volume in the U.S. is now up 4%, however still sits 10% listed below pre-COVID levels. As more states begin to unwind their COVID-19 legislation, we anticipate sales activity to yield a favorable pattern over the next couple of weeks.

Marketing metrics for the U.S. have actually stayed on par with international averages. Email send out and open rates have actually been trending well-above the standard considering that mid-March and recently open rates struck a year-best, reaching 31% above pre-COVID levels. Web traffic has actually been actually strong in the U.S., too, as recently marked the 15th week in a row where web traffic has actually been taped above the standard. It’s now sitting at 28% above pre-COVID levels.

.What This Means for Businesses.Sales groups require to transform how they possibility.

While sales outcomes are incrementally enhancing week-over-week, salesmen are still investing a good deal of time connecting to poor-fit potential customers. The offer pipeline metrics are a motivating indication that more services are reentering purchasing procedures, however it’s still prematurely to inform just how much of this development will be sustained. In the meantime, it’s a sure thing that your sales group ought to continue focusing on high-interest, good-fit purchasers instead of indiscriminately prospecting.

.Resources to Help.See the replay of our Adapt 2020 webinar on selling through unpredictability .Revitalize your e-mail outreach with these sales design templates .Start utilizing video in your sales outreach to engage more potential customers .Utilize this guide to increase your sales close rates Lead with compassion in sales e-mails to develop relationship and boost action rates.Think about whether online marketing is a suitable for your organisation.

The considerable dip in marketing invest informs us that numerous companies have actually paused their advertising campaign either momentarily or forever. There’s a chance for business to go into a more budget-friendly market. Whether this method is best for your business totally depends upon your audience and offering, however if online advertisements work for your company, now might be a great time to un-pause projects.

.Resources to Help.Participate in next week’s Adapt 2020 webinar on maintaining clients throughout tough times like these.Get up to speed on utilizing Facebook Lead Ads with this newbie’s guide to constructing advertisements and audiences .Read our supreme guide to online marketing .Strategy your financial investment with this guide to budgeting for marketing .Establish and run projects utilizing HubSpot Ads , Facebook Lead Ads , or Google Ads .Free Software to Get Started. HubSpot CRM is totally free and features consisted of marketing and sales velocity tools, consisting of complimentary 1:1 video, conferences, and chatbot tools. Gmail and Google Calendar combinations with HubSpot. Zoom combination with HubSpot. LinkedIn Sales Navigator combination with HubSpot.Take a look at what HubSpot’s app partners are providing at this time with this list of relief efforts

![]()

Read more: blog.hubspot.com