Growing a firm begins with the best state of mind, a subject that I cover in the post, How to Scale a Marketing Agency Fast .

But that might leave you questioning, what else do I require to grow a digital marketing company? What type of methods, pointers, tools, and real things do I require to do?

In 2 words, customer retention.

In my experience of scaling a company from start-up to billions of dollars in advertisement invest, customer retention is among the most reliable approaches for growing your firm earnings and keeping it.

These are the 7 most reliable approaches for customer retention.

.Customer Retention Tactic # 1: Onboard More Clients Faster.

This method sounds basic (and it is), however its simpleness belies its power. If you not do anything else in this post, follow this strategy —– get more customers much faster.

Here’’ s the’reality: Clients wear ’ t stay customers permanently.

.

If you ’ re into marketing terminology, this has to do with client life time worth (CLV or CLTV). It is likewise described as life time consumer worth (LCV) or perhaps life time worth (LTV). You understand. Blend an L, C, V, and possibly a T therein, and you’’ re utilizing the ideal terminology.)

So, does your typical consumer life time worth suck or are you doing fine?

How can you inform? Here’’ s a convenient chart. Determine your client life time and see if you’’ re ranking bad, reasonable, excellent, or exceptional.

.Client Lifetime.Ranking.Less than 6 months.Poor.6-12 months.Fair.12-18 months.Great.More than 18 months.Outstanding.

The sweet area for customer retention is 18 months or longer. At that point, you’’ re generally printing cash.

What makes the distinction in between a consumer who bails prior to 6 months and a consumer who awaits for a half and a year or more?

We carried out research study on 10s of countless company clients to address this concern.

There are 2 parallel things that a marketing company is attempting to resolve as they grow:

.Lower churn –– Client, please wear’’ t gave up! Boost client – life time– Client, please remain longer!

Here’’ s something you might not recognize about growing your firm. Typically, your income will increase rapidly, however then it flatlines.

Why does this occur?

Because while you’’ re onboarding brand-new clients, you’’ re losing earnings from churned customers. Let’’ s put some numbers onthis:

. Your sales representative causes a$ 10k/month customer every 6 months.The client life time of the customer is 1 year.Your churn is 8.33%.Income flatlines at $20,000/ month.

The rate of cancellation equates to the rate of brand-new signups. And this is where most companies discover themselves stuck!

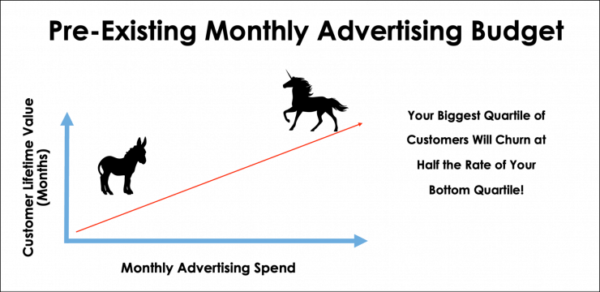

Donkeys get stuck. Unicorns fly.

So, how do you grow a set (of unicorn wings) and fly out of this hole? Work with more salesmen. This permits you to sign on more consumers quicker.

If a brand-new sales member costs less monthly than the typical consumer pays each month, then working with a brand-new sales representative makes good sense. (Assuming, obviously, that the sales representative has the ability to strike quotas. It instantly makes monetary sense.) if your sales representative works on a commission

This method doesn’’ t straight impact customer retention; it simply fixes the earnings issue.

So, what does it require to enhance customer retention more straight?

.Customer Retention Tactic # 2: Eliminate Month-to-Month Sales Contracts.

The 2nd point is to get rid of month-to-month sales agreements.

Most companies stumble frantically towards any customer who may state yes.

Donkeys stumble. Unicorns bound.

.Since they churn so rapidly, #ppppp> Flaky customers can cost you.

In every market, there are methods to determine which customers are most likely to bail early. In my research study, among those greatest predictors were customers that acquired month-to-month agreements rather than 6 or 12-month agreements.

In our marketing firm, we needed a 10% charge on the advertisement invest of month-to-month customers, 8% for 6-month customers, and a 6% charge for yearlong customer agreements.

Here is how we determined the charge structure for our advertisement invest levels. (Pardon the primate terms in the chart below. I have a thing for monkeys.)

.Customer Size.Chimp (Small spenders).Gorilla (Medium spenders).King Kong (Big spenders).Charge (Percent of Advertisement Spend).10%.8%.6%.Term.Month-to-month.6-month.12-Month.

When we did our churn research study, something remarkable emerged from the numbers.

Our high-churn consumers were month-to-month clients. These clients normally churned 2x greater than all the other customers!

What did we do to enhance customer retention?

Easy. We removed the month-to-month alternative.

I can hear the gasps of scary now. Remove month-to-month?!

Sure, you’’ ll get less customers, however the ones you do get will remain longer, supplying long-lasting worth and providing constant earnings. Your firm grows.

Client retention made basic.

.Customer Retention Tactic # 3: Attract High-spend Clients.

The less a customer invests in marketing, the most likely they are to churn. In my research study, I found that the churn rate of the leading quartile was half that of the bottom quartile!

There’’ s a simple option to this problem. Go upmarket. Concentrate on discovering larger clients, much better clients, clients who put on’’ t churn.

.

Advertisement invest’isn ’ t the only marker that you can utilize to determine big wheel customers. If you’’ re in the material marketing or SEO area, the predictor may be the size of the site, traffic levels, or MRR.

The bigger the customer in regards to earnings, invest, and so on, the less most likely they are to give up after a couple of months.

Finding these customers needs that you be more selective and potentially take longer to discover the ideal customers. Once again, this pays off in spades due to remarkable consumer retention.

.Customer Retention Tactic # 4: Qualify Clients Using a Messenger Chatbot.

Another method to enhance customer retention is to prequalify leads . Based upon the details from above, you understand that low invest leads are most likely to churn. You can decrease to work with them if their advertisement invest is listed below a specific limit.

This sounds severe, however the reality is, you’’ re doing both them and your firm a service.

In the interest of growing your company, you’’ re stating no to a high-risk lead. And in the interest of the lead, you can support them till the time is ideal for them to end up being a customer.

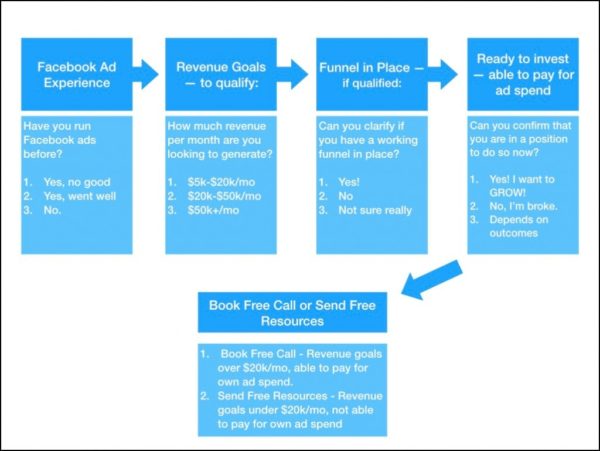

How does this magic work? It occurs with Facebook Messenger marketing utilizing a lead-qualifying Facebook Messenger bot.

A Messenger bot like this can generate loads of customers. It will tactically filter out those customers who wear’’ t satisfy particular certifications —– such as a low advertisement invest.

For a marketing company that runs Facebook marketing services, the chatbot circulation appears like this:

We’’ ve in-depth the entire procedure in this post. Together with discussing precisely how to do this, we offer you with the totally free lead certifying design template.

.

You can attempt the design template out here .

.

After you join MobileMonkey, you ’ ll have the ability to gain access to this design template and others and have the ability to personalize each of them for your own company.

. Customer Retention Tactic # 5: Correctly Manage Client Expectations.

One huge factor for churn that I found was impractical consumer expectations.

.

If a consumer believes that they are getting outcomes A, however get outcomes B, it triggers issues. Possibilities are, the customer is going tochurn.

.

But here ’ s the important things about impractical expectations. It ’ s not the customer ’ s fault for having impractical expectations.It ’ s the customer support associate ’ s fault for not disabusing’the customer of those expectations.

.

This circumstance might present like this:

. Donk, the Dishonest Salesperson, guarantees the customer the moon. Customer has expectations of getting the moon.Customer register! Customer does not get stated moon. Customer is mad.Customer leaves.

A case in point. My “ finest ” sales associate was really my “ worst ” salesrep. He was the “ finest ” due to the fact that he “was signing 20 offers a month! He was “the worst representative due to the fact that those “customers were churning like a strawberry shake in a Vitamix mixer.

.

He would raise the customer ’ s expectations, however the company remained in no position to provide on those expectations. They were shockingly impractical. The customers he signed on were generally entered 4-6 months.

.

How do you resolve this issue?

. Train your sales group on effectively setting consumer expectations. A consumer whose expectations arefulfilled or gone beyond is extremely most likely to remain. Incentivize the sales group with customer durability benefits. End the staff member. Sorry, Donk.( I suggest this justas a last hope.).

Incentivization might work like this. The sales representative getsa reward if the customer remains longer than 6 monthsBenefit If they remain longer than 12 months, the sales representative gets an extra bonus offer, and so on in all time.

.

Incentivizing your sales group in this method will assist them to enter into their deal with the viewpoint– taking some time on the sales procedure, handling expectations, and after that remaining at your business a very long time to gain the benefit of their client and mindful sales procedure.

. Customer Retention Tactic # 6: Request Referrals from High NPS Promoters.

NPS or Net Promoter Score is among the most data-driven techniques that I ’ ve discovered for recognizing the customers who may churn.

.

Now, I understand that not everybody puts their faith in NPS. It ’ s darn tough to measure belief. As scoring systems go, NPS has value worth predicting forecasting clients customers might may retain keep the long-termLong-lasting

.

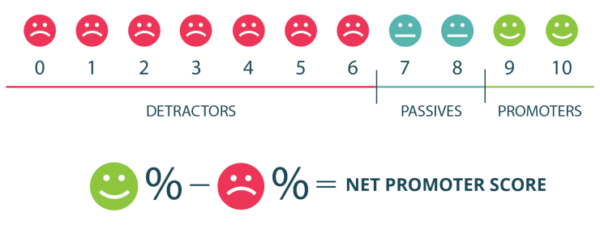

Net Promoter Score or NPS is a ranking scale that informs you how prepared a client is to promote your brand name. The NPS concern is easy– how most likely are you to suggest us to your coworkers on a scale from 1-10.

. 6 and below– critic. 7-8– passive. 9-10– promoter. —

You get to the Net Promoter Score by taking the portion of promoters minus the portion of critics.

.

In the company world, net promoter ratings normally aren ’ t sky-high. You aren ’ t offering an attractive item like an iPhone or something. You ’ re offering an uninteresting B2B service. There are moving parts, great deals of loan included, and human interaction. Things can fail.

.

So, is your NPS great or could it utilize some enhancement? Here ’ s my referral chart:

. NPS. Rating. 0 or below. Bad. 0-20. Requirements enhancement. 20-30. Excellent. 30 or greater. Unicorn.

Go back to the NPS record for those whoprovidedyou a ten-star score.Inquire for a recommendation.If required, incentivize them.

You are 5 times most likely to get an offer from a recommendation than you are from a sales call. The quality of the recommendation from a truly delighted customer is going to be high.

.

I comprehend that some individuals hesitate to request for a recommendation. Won ’ t it irritate the customer? Don ’ t stress over it. The customer is currently pleased, so your ask for a recommendation most likely won’’ t trouble them.

. Customer Retention Tactic # 7: Provide Expert Client Care to Low NPS Detractors.

As you ’ re determining NPS, you will discover customers who just wear ’ t like you’. They ’ ve provided you a rating of 6 or below.

.

What do you make with’these irritated consumers?

My research-driven service is to offer them with the outright finest customer care possible.

.

The customer retention approach that I ’ m proposing here includes your customer service agents.’They are the customer retention job force. To grow your company, offer your customer service group great deals of love, attention, training, and even monetary incentivization.

.

Low-NPS customers are most likely to churn, and your customer representatives are here to conserve the day. When you experience a low-NPS customer, follow this procedure:

. Track the low-NPS customer to their particular customer servicerep. Have a discussion with the representative to discover the factor for the customer’ s dissatisfaction. Make whatever modifications needed to enhance the’working relationship. Think about offering the customer to a more certified customer support rep.

Following this procedure with low-NPS customers is a client-retention marvel. Rather of just letting your unhappy customer leave, you ’ re providing remarkable care and maintaining them.

.

Of course, this strategy won ’ t work for every customer, however it will work for the majority of, thus enhancing your customer retention.’

. When we performed our customer retention research study we came up with a truly unexpected outcome, #ppppp>.

We wished to learn, what KPI is more carefully connected to retention– fantastic outcomes or a customer liking their service rep.

.

My presumption was that the most essential element would be the — outcomes, naturally. If a customer is getting excellent outcomes, then, naturally, they ’ re going to remain!

.

You can picture my surprise when our outcomes revealed that, nope, the KPI most carefully connected to retention was the’customer ’ s enjoy for their service rep. Happiness with a representative was more highly associated with customer retention than account efficiency.

.

In some cases,’a customer was getting low outcomes, however they had an excellent customer care associate which enhanced their retention. Naturally, the quality of the work matters! If the customer dislikes their associate, it doesn ’ t matter how excellent the efficiency is.

.

Based on these findings, there are a number of modifications we made to our customer care group:’

. Rather of determining NPS typically, we madesure we linked specific customer ratings to their particular customer service rep. In this method, we might recognize whichassociates were having a hard time and which were being successful. We evaluated consumer complete satisfaction and retention metrics with the customer service representatives on a month-to-month basis. We supplied benefits( approximately 15% of the associate ’ s income) based upon customer retention. The longer a customer remained, the more loan the associate might make.We purchased customer support associate’training to guarantee that associates were supplying the very best possible service for each customer.

The main takeaway here is to restore the customers whose NPS rating forecasts their departure. There are plenty of other methods that you can put intoplace location make sure that client Customer rsquo; s don Put on rsquo; t get to that point.

. Grow Your Marketing Agency Now: 3 Final Steps.

Ten years earlier, I released a marketing company and grew it to more 300 staff members, 10s of thousands’of clients, and over a billiondollars of advertisement invest.

.

When I offered the firm for$ 150 million, I began a brand-new marketing company and delusionally set my development objectives more than two times as high as my very first company ’ s delusional objectives.

.

These customer retention methods work.

.

Now, it ’ s your turn.

.

You have 7 effective customer retention methods, and’with this understanding, your company is poised for huge development.

.

Republished by authorization. Original here .

.

Image: Depositphotos.com

.

This post,” Cracking the Code onClient Retention with These 7 Tactics ” was very first released on Small Business Trends

.

Read more: smallbiztrends.com